Great Walls and Great Pivots: How Mutual Bans Forged an AI Cold War

As China bans Nvidia from state data centers and the US blocks Blackwell exports, Nvidia pivots toward India as the world's most valuable chipmaker navigates a geopolitical chessboard.

The geopolitical tectonic plates beneath the global AI industry shifted violently this week, when both the United States and China slammed their respective doors shut simultaneously. The result isn’t just a trade dispute, it’s the clearest signal yet that we’re witnessing the formal divorce of the world’s two largest tech ecosystems.

The Great AI Firewall Goes Both Ways

The move wasn’t subtle. On one side, China’s government issued guidance requiring that “new data centre projects that have received any state funds to only use domestically-made artificial intelligence chips”, a near-total ban on Nvidia, AMD, and Intel hardware from government-backed infrastructure according to Reuters reports ↗.

The enforcement is retroactive: projects less than 30% complete must remove already-installed foreign chips. This isn’t merely protectionism, it’s surgical excision of American technology from China’s strategic AI infrastructure.

Across the Pacific, the White House delivered its counterpunch. White House spokeswoman Karoline Leavitt stated unequivocally: “As for the most advanced chips, the ‘Blackwell’ chip, that’s not something we’re interested in selling to China at this time.” Treasury Secretary Scott Bessent later clarified the strategy amounts to maintaining “a multi-generational lead” by keeping China “two, three, four down their chip stack.”

From 95% to Zero: Nvidia’s China Collapse

Nvidia CEO Jensen Huang recently lamented the stunning reversal, stating, “We went from 95% market share to zero percent, and so, I can’t imagine any policymaker thinking that that’s a good idea.” That collapse represents billions in lost revenue, the company took a $5.5 billion charge earlier this year when Washington first banned its China-specific H20 chip.

The whiplash in U.S. policy has been particularly brutal. After banning the H20 in April, the administration reversed course three months later, only to see Beijing launch its own security probe into those same chips over fears of hidden backdoors. By August, Chinese tech giants were informally urged to halt H20 purchases, prompting Nvidia to suspend production entirely.

The message became unmistakably clear: neither government wants the other to have access to cutting-edge AI hardware.

China’s Subsidized Self-Sufficiency Push

Beijing isn’t merely banning foreign chips, they’re building an industrial policy fortress around domestic alternatives. The government recently began offering massive energy subsidies of up to 50% specifically targeted at data centers using homegrown AI processors. This strategic move offsets the higher power consumption and lower efficiency of Chinese chips compared to Nvidia’s mature hardware.

The beneficiaries are clear: Huawei has significantly ramped up production of its Ascend series, while smaller players like Shanghai-listed Cambricon and startups MetaX, Moore Threads, and Enflame receive state backing. Analysts now project domestically made AI server chips will capture 40% of the entire Chinese market by the end of 2025.

This domestic push comes amid what many observers characterize as persistent underestimation of Chinese technological capabilities. As one Reddit comment noted, “If there was another country out in the world called America, and basically a perfect mirror for the USA in NA, you better believe people would take them seriously if they said they planned to surpass the NA USA.”

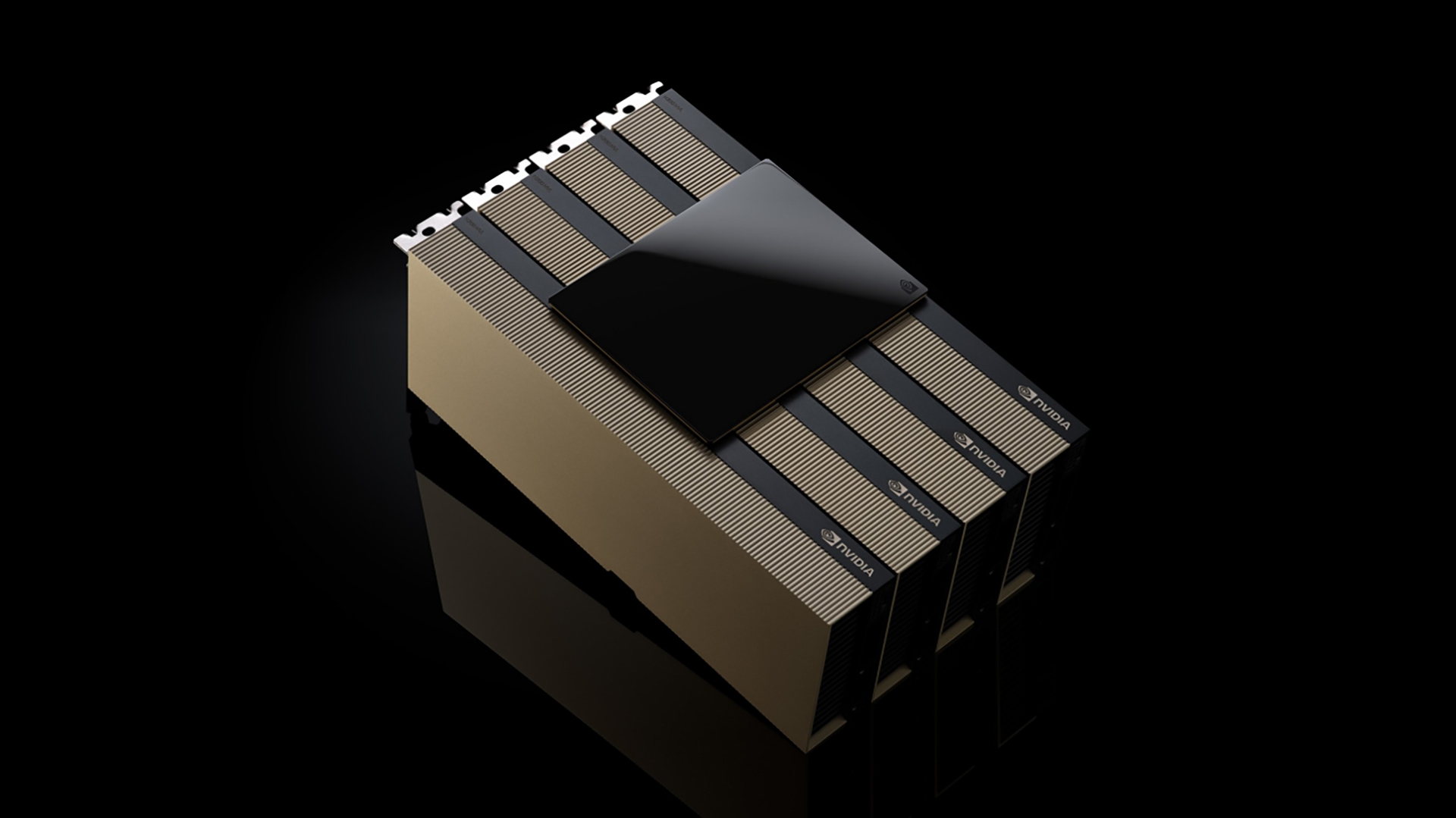

The Blackwell Blockade: Technical Walls Rising

The U.S. ban specifically targets Nvidia’s Blackwell architecture, the cutting edge of AI chip technology. These chips represent a quantum leap over previous generations:

- Massive Scale: Engineered for trillion-parameter AI models with up to 20 petaFLOPS of FP4 AI performance per GPU

- Advanced Interconnects: NVLink 5.0 provides 1.8 terabytes per second of bidirectional throughput

- Specialized Hardware: Dedicated decompression engines accelerate data processing bottlenecks

The strategic significance isn’t lost on industry observers. By denying China access to this hardware, the U.S. aims to create what amounts to a 3-5 year performance gap in AI capabilities, what some analysts call an “AI defense measure” echoing Cold War-era technology embargoes.

India’s Unexpected Rise as Neutral Ground

While doors closed in China, Nvidia pivoted decisively toward India. The company recently joined the India Deep Tech Alliance ↗ as a founding member and strategic advisor, aligning with investors who have committed $2 billion to nurture Indian startups in foundational technologies like semiconductors and AI.

This isn’t charity, it’s strategic repositioning. As Vishal Dhupar, Nvidia’s managing director for South Asia, stated, the company aims to “provide guidance on AI systems, developer enablement, and responsible deployment, as well as to work with policymakers, investors, and entrepreneurs to foster a sustainable AI innovation environment in India.”

The timing aligns perfectly with New Delhi’s own ambitions. India recently rolled out a $12 billion plan to bolster research and development capabilities, aiming to transition its economy from services to manufacturing and innovation. Despite India’s strong services sector, venture funding for deep-tech startups accounted for only a fifth of total startup funding last year despite a 78% rise.

The Global AI Ecosystem Splinters

We’re witnessing the birth of what industry observers increasingly call an “AI Cold War”, two separate technological ecosystems developing in parallel with different chips, different software stacks, and different rules.

The implications extend far beyond Nvidia’s balance sheet. Chinese AI companies, including giants like Baidu and Alibaba, will be forced to rely on older, less powerful hardware or significantly accelerate their domestic chip development. Meanwhile, U.S. AI labs and tech companies gain exclusive access to Blackwell’s unparalleled computational power, potentially accelerating breakthroughs that Chinese competitors cannot match.

The fragmentation risks creating what one observer described as “two separate ecosystems, different chips, different rules, different powers.” This technological decoupling could slow global AI innovation as researchers in different regions no longer benefit from shared advancements.

What Comes Next in the Chip Wars

Several critical developments bear watching:

China’s Domestic Push: Huawei has outlined ambitious plans for four new Ascend chip releases by 2028. While their current offerings lack parity with Nvidia’s mature software ecosystem, the combination of massive state subsidies and protected market access could accelerate catch-up.

India’s Ecosystem Buildout: Nvidia’s mentorship through its Deep Learning Institute represents a long-term bet on India becoming the next major AI hub. The company joins Google, which recently pledged $15 billion for an AI hub in Visakhapatnam.

Secondary Market Effects: Already, reports indicate Chinese firms are turning to used Nvidia GPUs following the H20 crackdown. The gray market for restricted chips will likely expand as workarounds emerge.

The Broader Implications

Beyond immediate market impacts, these developments signal a fundamental restructuring of global technology supply chains. What began as trade friction has evolved into strategic technological containment, with AI hardware emerging as the primary battlefield.

As one Reddit comment noted, “America bans selling chips. China makes its own chips. 5 years later China chips are better and 1/5th price. Only a wizard like Trump could consistently fail the same way over and over.” Whether this prediction proves accurate remains to be seen, but the incentives for Chinese innovation have never been stronger.

The wild card remains whether other nations will align with either technological sphere or develop their own alternatives. India’s rise as a potential neutral ground, courted by both sides but aligned with neither, could reshape global tech alliances for decades.

The New Normal: Bifurcated Innovation

The simultaneous bans represent more than just protectionist policies, they’re the formal acknowledgment that AI has become too strategically important for global cooperation. We’ve entered an era where technological sovereignty trumps economic efficiency, where national security concerns override market principles.

For developers and companies operating in this new landscape, the rules have fundamentally changed. The universal CUDA ecosystem that dominated AI development is fracturing, with Chinese alternatives emerging and India developing its own path. The question is no longer whether there will be one global AI ecosystem, but how many parallel ecosystems will emerge, and at what cost to collective progress.

The AI race just became a relay with separate tracks. And everyone’s running their own race now.