The Post-AI Gold Rush: What Industry Actually Replaces the Revolution?

Tracing the historical pattern of wealth-creating industries from oil to AI, and speculating on what comes next when the bubble bursts.

If you look at history, every few decades a new industry shows up that completely reshapes wealth creation and mints a fresh class of billionaires. The 1900s had oil & railroads. The 1980s gave us hedge funds & private equity. The 2000s were dominated by tech, followed by apps in the 2010s. Now, we’re living through the AI/crypto boom of the 2020s. The question isn’t whether AI is transformative, it’s what comes after the dust settles.

The prevailing sentiment on developer forums is that we’re in the middle of an unprecedented bubble. The data backs this up. According to a recent Wall Street Journal investigation, the AI bubble is vastly larger than any other bubble in recent history, including Worldcom’s fraud-soaked fiber optic bonanza. These companies aren’t just losing money, they’re incinerating it at a rate that defies historical precedent.

Consider the math. Bain & Co. reports that the AI sector needs to generate $2 trillion in new revenue by 2030 ↗ just to break even on current investments. That’s more than the combined revenue of Amazon, Google, Microsoft, Apple, Nvidia, and Meta. The actual revenue? Morgan Stanley puts it at $45 billion annually ↗, and that’s using the industry’s own cooked books where annual revenue is often just annualized best-month revenue multiplied by 12.

The Physics of the Bubble

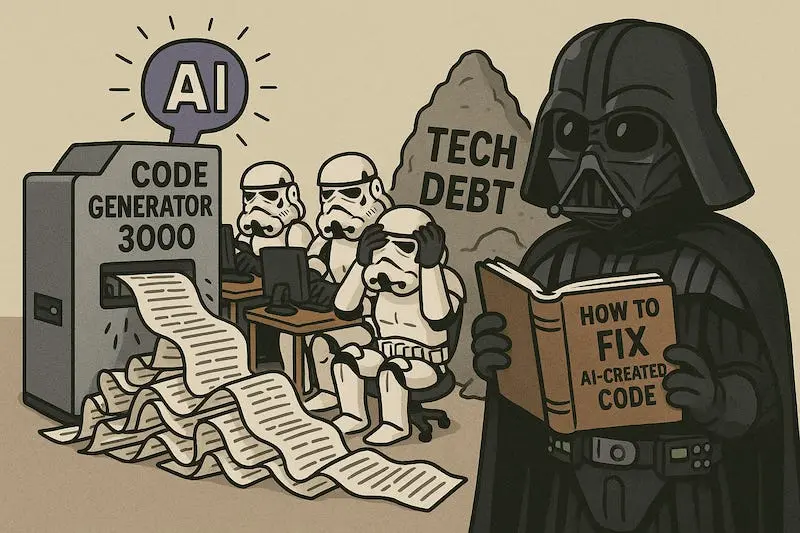

The fundamental problem with AI isn’t the technology, it’s the economics. Unlike early internet companies that got cheaper with scale and technological advancement, AI has what Ed Zitron memorably calls “dogshit unit-economics.” Each generation of AI is vastly more expensive than the last, and each new customer makes AI companies lose more money.

The accounting practices would make Enron blush. Microsoft “invests” in OpenAI by giving them free server access. OpenAI reports this as a ten-billion-dollar investment, then redeems these “tokens” at Microsoft’s data centers. Microsoft then books this as ten billion in revenue. It’s the same chunk of money being energetically passed back and forth between closely related companies, all claiming it as investment, as an asset, and as revenue simultaneously.

This financial house of cards has real-world consequences. Data center companies are collateralizing their loans by staking GPUs as collateral, an absurd proposition given that nothing loses value faster than silicon chips, especially AI-grade GPUs that burn out by the tens of thousands over a single 54-day training run. As one analyst put it, “Talk about sweating your assets.”

The Post-Bubble Landscape

When the bubble bursts, and anything that can’t go on forever eventually stops, what’s left? The answer might surprise you. The real opportunity won’t be in AI itself, but in what the bubble leaves behind.

Imagine a future where you can buy GPUs for ten cents on the dollar. Where there’s a buyer’s market for hiring skilled applied statisticians. Where there’s a ton of extremely promising open-source models that have barely been optimized and have vast potential for improvement. This isn’t speculation, it’s the predictable aftermath of every major tech bubble.

The most likely candidates for the next wave of wealth creation aren’t entirely new industries but rather practical applications of technologies that will become absurdly cheap post-bubble:

Autonomous Robotics

While LLMs can do the thinking, they don’t have a body. Autonomous robots that can think with AI and actually complete physical tasks represent the logical next step. The conversation on tech forums suggests this is an (unfortunately literal) arms race for businesses to create robots that can work in any situation. A solar-powered, corporate-owned multi-trade robot with integrated wrench-hands that can assess and complete a job 10x quicker with no salary for 20 years after a single upfront payment? That’s not science fiction, it’s the inevitable endpoint of current trends.

Quantum Computing

According to Forbes’ technology trends for 2026 ↗, quantum computing is poised for real-world adoption. While it won’t noticeably affect our day-to-day lives immediately, the impact on business, industry, and science will be profound. Financial modeling will become more accurate, drug discovery will accelerate, and logistics will achieve new levels of efficiency. This represents a fundamental shift in computing power comparable to the leap from valve-based computers to microprocessors.

Energy Infrastructure

The AI bubble has exposed tech’s energy crisis. Data centers accounted for 4% of global energy consumption in 2024, predicted to double ↗ by decade’s end. The solution isn’t just more power, it’s new energy solutions like hydrogen fuel cells, biofuels, and modular nuclear reactors. The companies that solve tech’s energy problem won’t just be enabling AI, they’ll be building the infrastructure for the next century of technological progress.

The Human Factor

Perhaps the most overlooked opportunity is in what happens when humans are no longer the primary drivers of productivity. As Yale economist Pascual Restrepo points out in his paper on artificial general intelligence, we’re heading toward a world where wages no longer track productivity and output. Instead, pay reflects the cost of replacing workers with computing power.

This creates two fundamental dilemmas. The first is political: how to redistribute the gains from compute through universal dividends or reimagine compute as a public resource with broadly shared returns. The second is human: how to find meaning and structure in our lives when economic logic says we “won’t be missed” in the labor force.

The companies that solve these problems, whether through new social safety nets, new models of ownership, or new ways of finding purpose beyond traditional work, will define the post-AI economy.

The Real Revolution

The dirty secret about the “AI revolution” is that it’s not really about AI. It’s about the predictable cycle of technological bubbles and their aftermath. The real wealth isn’t being created by AI companies burning through billions, it’s waiting in the technologies that will become accessible when the bubble pops.

The next wave of billionaires won’t be AI evangelists but opportunistic scavengers who capitalize on the bubble’s collapse. They’ll be the ones buying distressed data centers for pennies on the dollar, hiring laid-off AI researchers at bargain prices, and building practical applications on technologies that were previously too expensive to implement at scale.

So what’s the next billionaire-making industry after AI? It’s not a single sector but a constellation of opportunities emerging from AI’s ashes: practical robotics, accessible quantum computing, sustainable energy infrastructure, and new models of human organization and purpose. The revolution isn’t coming from the bubble, it’s coming from the burst.

The smart money isn’t betting on AI to solve everything. It’s betting on what happens when it doesn’t.