Event Sourcing in Finance: The Architecture That Developers Love to Hate

Debunking the myth that event sourcing is easier for financial systems despite its audit trail benefits versus CRUD familiarity

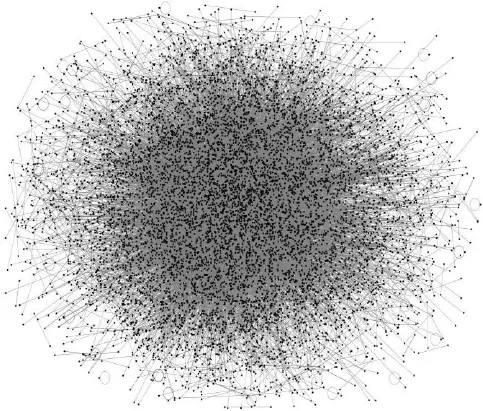

The debate raging across engineering teams isn’t about tabs versus spaces, it’s about whether event sourcing actually makes financial systems easier to build, or if it’s just architectural overkill that makes developers miserable. The truth lies somewhere between the purists and the pragmatists.

The Developer’s Dilemma: CRUD Comfort vs Event Sourcing Complexity

The core conflict emerges from a fundamental mismatch: financial systems naturally demand event sourcing’s immutable audit trails, while most developers have spent their careers thinking in CRUD patterns. As one architect noted, developers are “conditioned to build CRUD systems” because that’s what most tutorials, frameworks, and existing codebases teach.

The argument typically goes like this: pro-event-sourcing advocates claim adding new features is just “another projection”, while the CRUD camp counters that event sourcing requires “too hard for developers to get their head around.” Both sides have valid points, but the financial domain tilts the scales significantly.

Why Financial Systems Can’t Afford CRUD’s Amnesia

Imagine your bank operated on pure CRUD principles. Someone executes UPDATE accounts SET balance = 1000000 WHERE account_id = 123 and suddenly money appears, or disappears, with no record of how it happened. Regulatory bodies would have aneurysms, forensic accountants would quit, and customers would rightfully flee.

Event sourcing provides guarantees that financial institutions literally cannot operate without:

- Complete audit trails showing every state change

- Regulatory compliance baked into the architecture

- Resilience and recovery through event replay

- Protection against direct database manipulation

As one developer bluntly put it: “Imagine if money went missing and there was no audit trail. Imagine if databases could be manipulated directly just by changing someone’s account balance with a SQL update statement. I don’t think you want that.”

The Implementation Reality: It’s Not Just Adding Events

The myth that event sourcing is “just” storing events collapses under real-world implementation. Teams report that event sourcing demands “a lot more effort in up front planning” requiring deep collaboration with subject matter experts to properly model domain events.

The challenges are substantial:

- Identifying aggregates and boundaries

- Modeling how replays and projections work

- Convincing a critical mass of developers this is better than CRUD

- Handling eventual consistency in user interfaces

- Managing performance as event streams grow

Many developers push back, calling event sourcing “over-engineering” for most use cases. They’re not wrong, for simple CRUD with basic audit needs, traditional logging often suffices.

When Event Sourcing Actually Makes Sense (And When It Doesn’t)

The sweet spot for event sourcing isn’t everywhere, it’s where the complexity pays for itself. Financial systems sit squarely in this zone because:

Do use event sourcing when:

- You need complete historical accuracy (financial transactions, compliance)

- Debugging requires replaying exact sequences (fraud detection)

- Business logic evolves frequently (regulatory changes)

- Multiple systems need to interpret the same events differently

Avoid event sourcing when:

- You’re building simple CRUD with basic audit needs

- Immediate consistency is non-negotiable (high-frequency trading)

- Your team lacks distributed systems experience

- The business domain doesn’t have complex state transitions

The Developer Experience: Why It Feels So Hard

The cognitive shift from CRUD to event sourcing is substantial. Instead of thinking “update this record”, developers must think “create an event representing this state change.” Instead of simple queries, they manage projections. Instead of immediate consistency, they handle eventual consistency.

This mental model shift explains why developers with 7+ years of event sourcing experience see it as “easier”, they’ve internalized the patterns. For everyone else, it feels like learning to write with their non-dominant hand.

The Payoff: Debugging Superpowers and Regulatory Compliance

When implemented correctly, event sourcing provides capabilities that border on magical for financial systems. The ability to replay any transaction sequence exactly as it occurred transforms debugging from forensic archaeology into precise science.

Regulatory compliance becomes inherent rather than bolted-on. Want to prove to auditors exactly what happened during Q3 2024? Replay the events. Need to demonstrate that customer data handling followed GDPR guidelines? The event stream is your evidence.

The Pragmatic Path Forward

The solution isn’t all-or-nothing adoption. Successful teams implement event sourcing selectively where it makes sense, often starting with PostgreSQL as their event store rather than immediately reaching for Kafka or specialized event stores.

They incrementally introduce the patterns, proving value before demanding full adoption. They acknowledge that eventual consistency requires UX consideration, users might see stale data immediately after updates, and design accordingly.

Most importantly, they recognize that financial systems have different requirements than typical web applications. The extra complexity of event sourcing isn’t over-engineering when millions of dollars and regulatory compliance are at stake.

The Verdict: Necessary Complexity for Financial Domains

The debate ultimately resolves to this: event sourcing is harder for developers initially because it requires unlearning CRUD patterns. But for financial systems, it’s ultimately easier because it provides capabilities that CRUD fundamentally cannot.

The choice isn’t between “easy” and “hard” but between “initially uncomfortable” and “architecturally inadequate.” Financial systems that choose CRUD for developer comfort eventually pay the price in audit failures, regulatory violations, and debugging nightmares.

The developers who stick with event sourcing through the initial discomfort eventually discover something surprising: they can’t imagine going back to systems that forget their own history. The audit trails, the debugging capabilities, and the business flexibility become non-negotiable.

In financial technology, event sourcing isn’t optional, it’s essential. The initial learning curve is just the price of admission for building systems that actually work for the domain.