SASE Vendors Are Lying About Their Security Stacks

A brutal breakdown of how Zscaler, Palo Alto, and Cloudflare actually perform when real traffic hits their global PoPs, and why pricing transparency is a myth.

The SASE market has become a shouting match between vendors claiming “comprehensive” security stacks while quietly routing your traffic through Frankenstein architectures held together by marketing promises.

The Performance Mirage Behind Global PoPs

Every SASE vendor brags about their global Points of Presence (PoPs), but the real test happens when Asian remote workers try to access European SaaS applications during peak hours. Zscaler’s private backbone delivers consistent latency, but their TLS inspection can add 15-20ms overhead that doesn’t appear in marketing demos.

Cloudflare’s network leverages their CDN infrastructure for impressive throughput, but enterprises report occasional routing anomalies when traffic gets optimized for performance rather than security. One financial services team discovered their “secure” traffic was taking suboptimal paths during market hours because Cloudflare’s network prioritized speed over consistent security enforcement.

Security Stack Roulette: What You’re Actually Buying

The security component evaluation reveals staggering gaps between vendor claims and reality:

Zscaler leads in SSE capabilities with deeply integrated CASB and DLP, but their SD-WAN functionality remains weaker than specialized players. Their recent AI security additions feel bolted-on rather than native.

Palo Alto’s Prisma SASE 4.0 introduces browser-level security that actually addresses modern threats, but requires completely new deployment models that invalidate existing investments. Their “AI-augmented data classification” promises 10x fewer false positives, but early adopters report significant tuning requirements.

Cloudflare offers the most developer-friendly platform but struggles with enterprise-grade DLP and compliance requirements. Their zero trust implementation works beautifully for technical teams but frustrates security auditors who need detailed logging.

The Pricing Transparency Charade

None of the major vendors provide clear pricing without lengthy sales engagements. Zscaler’s consumption-based model leads to unpredictable quarterly bills, while Palo Alto’s bundled approach forces purchases of unused components.

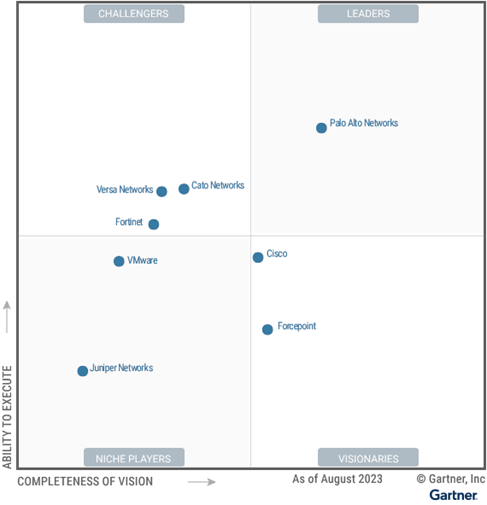

Cloudflare’s transparent per-user pricing seems attractive until you realize their security add-ons cost more than the base platform. The niche players like Cato Networks and Netskope offer more straightforward pricing but lack the global footprint of the giants.

The Integration Lie

Every vendor claims “seamless integration” with identity providers and EDR tools, but the reality involves months of professional services. Zscaler’s Azure AD integration requires custom SCIM implementations, while Palo Alto’s Okta integration struggles with dynamic policy enforcement.

The emerging niche players actually deliver better API-first approaches but lack the enterprise support muscle when integrations break at 2 AM during an incident.

The Compliance Gap

Regulated industries discover too late that SASE vendors interpret compliance requirements differently. One healthcare organization found their Zscaler implementation wasn’t HIPAA-compliant because logged data was processed in non-compliant regions. Financial services teams using Cloudflare hit PCI-DSS walls when they couldn’t guarantee data residency.

The market is converging toward two models: comprehensive but complex platforms (Zscaler, Palo Alto) versus agile but limited specialists (Cloudflare, niche players). There’s no perfect solution, only tradeoffs between security depth, performance consistency, and management overhead.

Enterprises that deployed SASE successfully started with limited pilots, tested real-world traffic patterns, and negotiated contracts that included performance SLAs rather than just availability metrics.

The vendors winning enterprise deals aren’t those with the most features, but those who can prove consistent performance during actual business operations rather than optimized demos. Because in the world of SASE, the gap between marketing claims and production reality remains wider than any vendor will admit.