The AI boom has a dirty secret: its foundation is built on circular IOUs. Nvidia, the world’s most valuable company, isn’t just selling shovels during a gold rush, it’s accepting future promises in lieu of cash. More than 50 equity-for-chips deals this year, including a $100 billion position in OpenAI and a $15 billion co-investment in Anthropic, have transformed the chipmaker from a supplier into the sector’s shadow banker. The arrangement seems clever until you map the web: AI startups trade equity for compute, cloud providers trade equity for customers, and everyone trades equity for survival. The last time wealth pooled in such obscure overlapping arrangements, Lehman Brothers collapsed.

The Circular Firing Squad

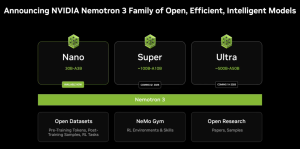

Here’s how the machine works. OpenAI needs Nvidia’s H100 GPUs but lacks the cash. Nvidia has chips but needs to maintain its 90% market share dominance. The solution? OpenAI hands Nvidia equity that only has value if OpenAI succeeds. OpenAI then signs $300 billion in computing deals with Oracle, $38 billion with Amazon, and $22 billion with CoreWeave. Those cloud providers, in turn, buy more Nvidia chips. Everyone wins, as long as the music keeps playing.

CoreWeave reveals the absurdity. The former crypto-mining operation projects $5 billion in revenue this year against $20 billion in spending. To bridge the gap, it’s taken on $14 billion in debt, over half due within 12 months. Microsoft accounts for 70% of its revenue, Nvidia and OpenAI make up another 20%. Nvidia is simultaneously CoreWeave’s exclusive supplier, investor, and customer. CoreWeave uses Nvidia’s money to buy Nvidia’s chips, then rents them back to Nvidia. This isn’t a business model, it’s a financial tautology.

When “Innovation” Means “Hide the Debt”

The desperation becomes clearer when examining the engineering of these obligations. Meta’s $27 billion Louisiana data center wasn’t financed through a traditional loan. Instead, Meta partnered with Blue Owl Capital to create a special-purpose vehicle (SPV), a legally separate entity that borrows money on Meta’s behalf, builds the facility, then leases it back. The debt vanishes from Meta’s balance sheet, preserving its credit rating.

SPVs aren’t new. They were instrumental in the 2008 crisis, when banks used them to hide billions in subprime mortgage exposure. Enron used them to mask fraudulent accounting. As Paul Kedrosky, a managing partner at SK Ventures, told The Atlantic: “When I see arrangements like this, it’s a huge red flag. It sends the signal that these companies really don’t want the credit-rating agencies to look too closely at their spending.”

The parallels multiply. Data-center debt is being sliced into asset-backed securities and sold to investors, exactly how mortgage debt was repackaged before the crash. Several providers, including CoreWeave, have taken out GPU-backed loans, using existing chips as collateral to buy more chips. If new model releases devalue older GPUs, lenders could call in loans, forcing mass chip sales that further collapse prices. Mark Zandi, chief economist at Moody’s Analytics, stated: “A few months ago I would have told you that this was building toward a repeat of the dot-com crash. But all of this debt and financial engineering is making me increasingly worried about a 2008-like scenario.”

The Math Doesn’t Work

The fundamental disconnect: AI companies will generate $60 billion in revenue this year against $400 billion in spending. OpenAI alone is on track to lose $15 billion, projecting profitability only by 2029, yet it needs $300 billion just to fund its Oracle deal. This year’s data center spending matches Denmark’s entire economy, by 2030, it could reach $7 trillion.

Proponents argue AI revenue is growing ninefold every two years and will outpace costs. But even if that exponential growth continues, the financing structure remains fragile. Morgan Stanley projects AI sector debt hitting $1.5 trillion by 2028. Private-equity firms have already pumped $450 billion into private credit for tech, with $800 billion more expected. These firms aren’t banks, they lack depositors and operate in regulatory darkness. The Federal Reserve estimates a quarter of bank loans to nonbank institutions now flow to private-credit firms, up from 1% in 2013. Life insurers have nearly $1 trillion exposed.

When, not if, a major AI startup fails, the cascade begins. Equity evaporates, debt defaults ripple through SPVs, private-credit firms collapse, and banks discover their “safe” loans to shadow lenders are anything but. Yale professor Natasha Sarin warns: “Unfortunately, it usually isn’t until after a crisis that we realize just how interconnected the different parts of the financial system were all along.”

The Government Is Pouring Kerosene

In 2008, regulators were caught off guard. In 2025, they’re actively deregulating. An August executive order directs federal agencies to let ordinary 401(k) holders invest directly in private credit, the same shadowy asset class propping up AI’s debt. The move exposes retirement accounts to equity-for-chips pyramids that could unwind violently.

The counterargument, voiced by Bank of America analysts, claims today’s valuations are “more closely tied to earnings growth” than the dot-com era. They point to Fed rate cuts in 2026 as a cushion. But this misses the point: 2008 wasn’t about stock valuations. It was about hidden leverage in off-balance-sheet vehicles and collateral chains that vaporized when housing prices stopped rising. Today’s AI bubble has the same DNA, just with GPUs instead of mortgages.

The Hard Truth for Engineering Leaders

For engineering managers and CTOs, this isn’t abstract finance. It directly impacts infrastructure planning, vendor relationships, and long-term architecture decisions. Betting your stack on a cloud provider that’s secretly insolvent means your AI models, data pipelines, and compute access vanish overnight when the SPV behind your data center gets margin-called.

The “CUDA moat” that gives Nvidia pricing power also creates systemic risk. If your startup’s equity is tied up in a chip provider, you’re not just a customer, you’re a hostage. And when the bubble bursts, the winners won’t be the companies with the best models, but those with the cleanest balance sheets and the fewest circular dependencies.

The AI revolution may be real. But it’s being financed with Monopoly money, and Nvidia is the banker. When the bill comes due, the entire table will discover the bank was empty all along.