Nvidia’s CES keynote used to be Christmas morning for PC gamers. This year, it’s the day the coal arrived. For the first time in half a decade, Team Green will announce zero new GPUs at the industry’s biggest showcase, quietly confirming what enthusiasts have dreaded: the RTX 50-series momentum has flatlined, and AI’s appetite has devoured the consumer market.

The official line? “No new GPUs will be announced.” The reality? A German distributor just told retailers they can’t even get RTX 5070 Ti, 5080, or 5090 cards, period. Meanwhile, a 128GB DDR5 kit now costs more than an RTX 5080, and Newegg is throwing in a $50 Starbucks gift card to sweeten the absurdity. This isn’t a supply hiccup. It’s a strategic funeral for the gaming GPU market as we’ve known it.

The Supply Chain Has Already Collapsed, You Just Didn’t Notice

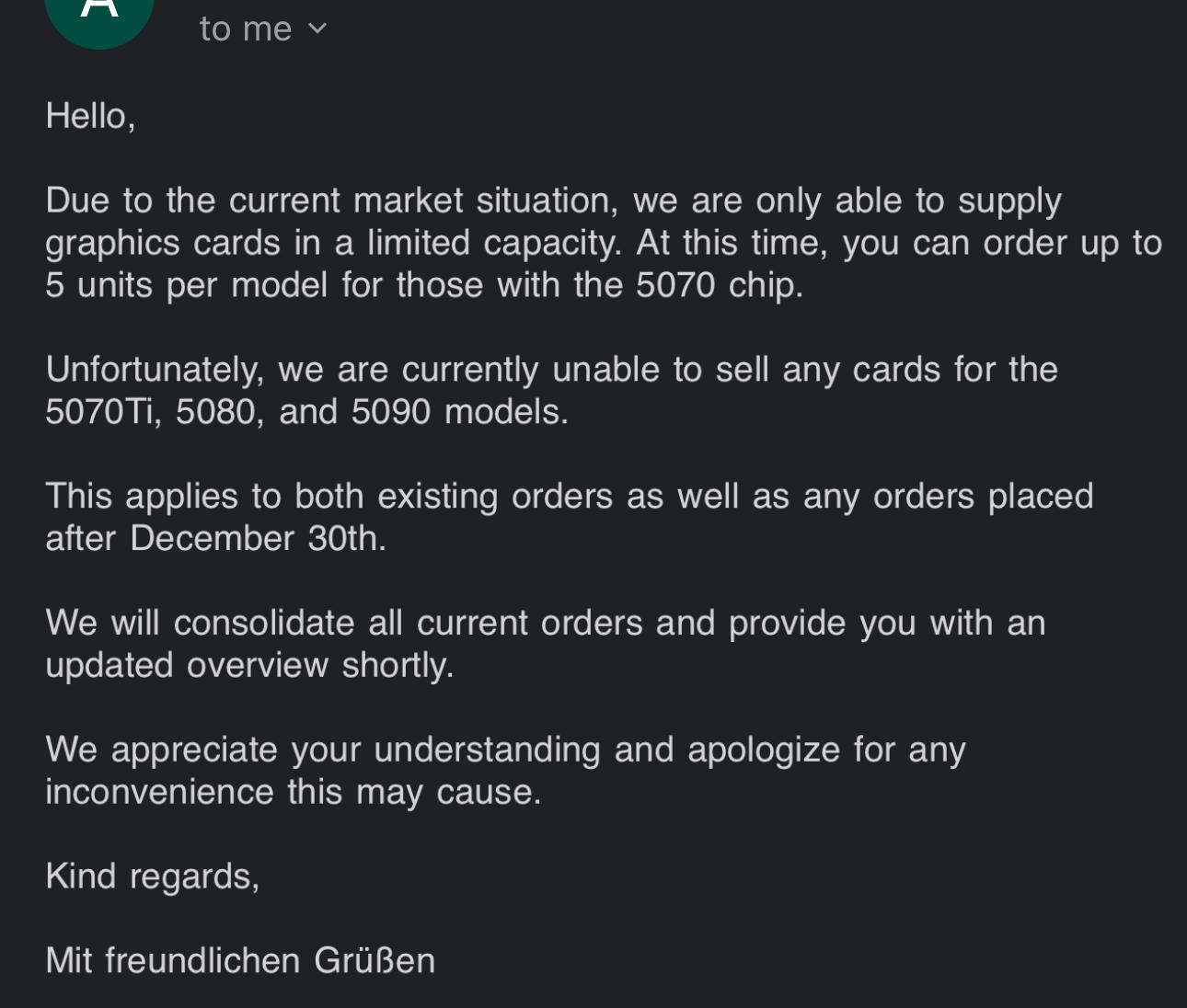

While Jensen Huang prepares to talk AI robotics at CES, the consumer GPU distribution network is hemorrhaging. A European retailer shared an email from a major distributor that reads like a death warrant: RTX 5070 cards limited to five units per model, with 5070 Ti, 5080, and 5090 models completely unavailable. The distributor canceled €20,000 worth of existing orders, citing “market conditions.”

This isn’t isolated. Japanese retailers started rationing GPUs weeks ago. The same pattern is emerging globally: high-end RTX 50-series cards are becoming unicorns. Retailers who can source them are paying premiums that make the already-inflated MSRPs look quaint. One report suggests Nvidia is slashing RTX 50 production by 30-40% in Q1 2026, with the RTX 5060 Ti and 5070Ti, cards that use 16GB of GDDR7 memory Nvidia would rather sell to AI clients for fatter margins.

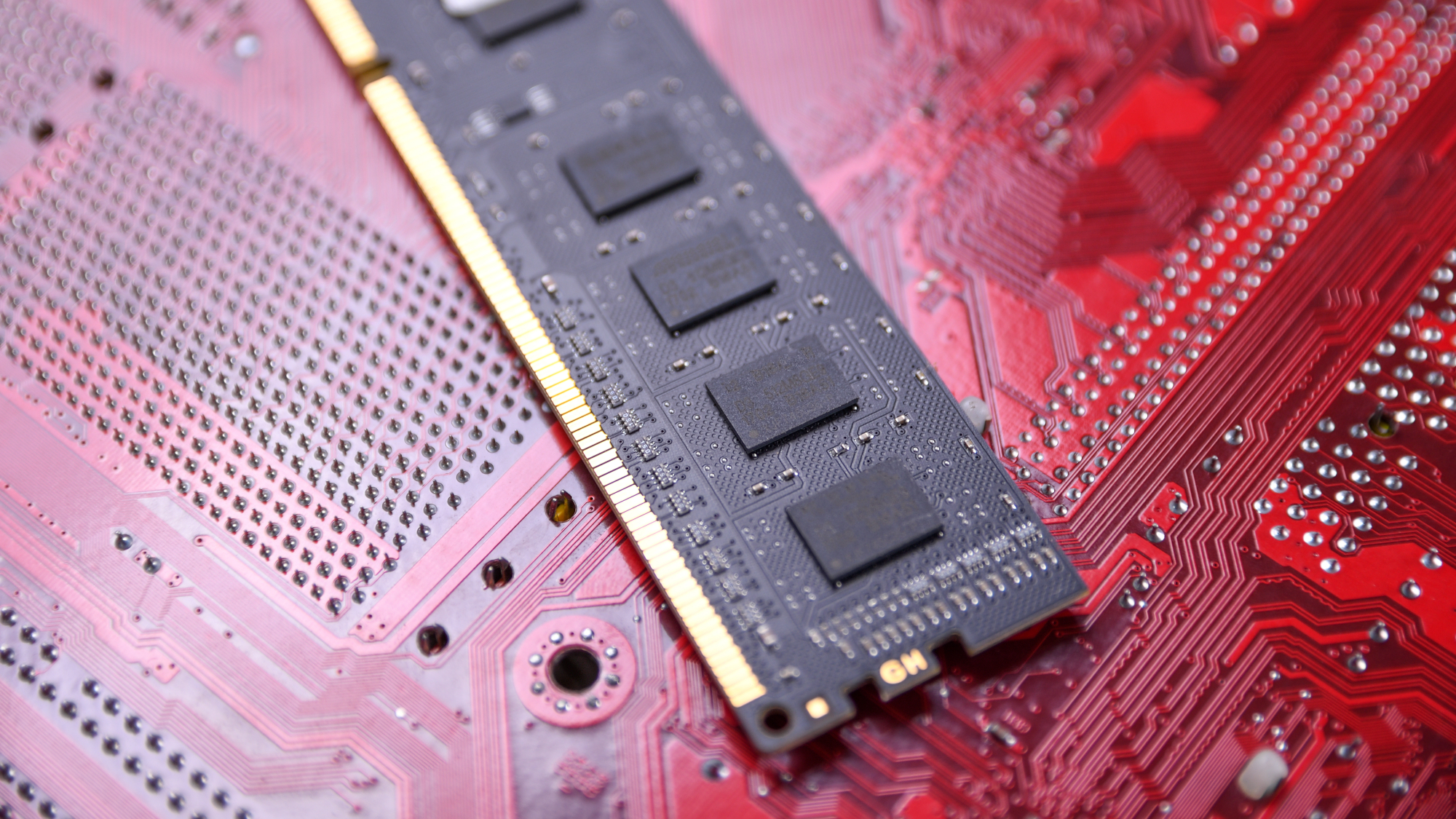

The memory crisis is the smoking gun. Only three companies, Micron, SK Hynix, and Samsung, manufacture cutting-edge DRAM, and they’ve all prioritized AI data center contracts. SK hynix has reportedly sold out its entire DRAM, NAND, and HBM supply to Nvidia through 2026. For context, that’s not just VRAM for GPUs, that’s system RAM, SSD controllers, and AI accelerators. The consumer market is now fighting for scraps.

When DDR5 Costs More Than Your Graphics Card

Let’s talk numbers that should make any PC builder weep. Newegg is currently selling a G.Skill Trident Z5 Neo RGB 128GB DDR5-6000 kit for $1,459.99. To soften the blow, they’re bundling a $50 Starbucks gift card with the tagline “Drink Coffee while you game!!” This isn’t marketing, it’s a coping mechanism for a market gone mad.

According to Tom’s Hardware, the average selling price for a 64GB DDR5-6000 kit has skyrocketed to over $800, nearly four times September 2025 levels. IDC warns the PC market could shrink by 9% as consumers simply can’t afford to upgrade. The research firm doesn’t mince words: “AI-driven shortages slam into PC market.”

But here’s the kicker: this isn’t scarcity due to manufacturing failure. It’s manufacturing redirection. AI companies are vacuuming up memory production capacity, paying premiums that make consumer pricing look like pocket change. When a data center order for HBM3e can run into hundreds of millions, why would Samsung care about a gamer buying a 32GB kit?

Nvidia’s Strategic Pivot: From GeForce to “Ge-No-Force”

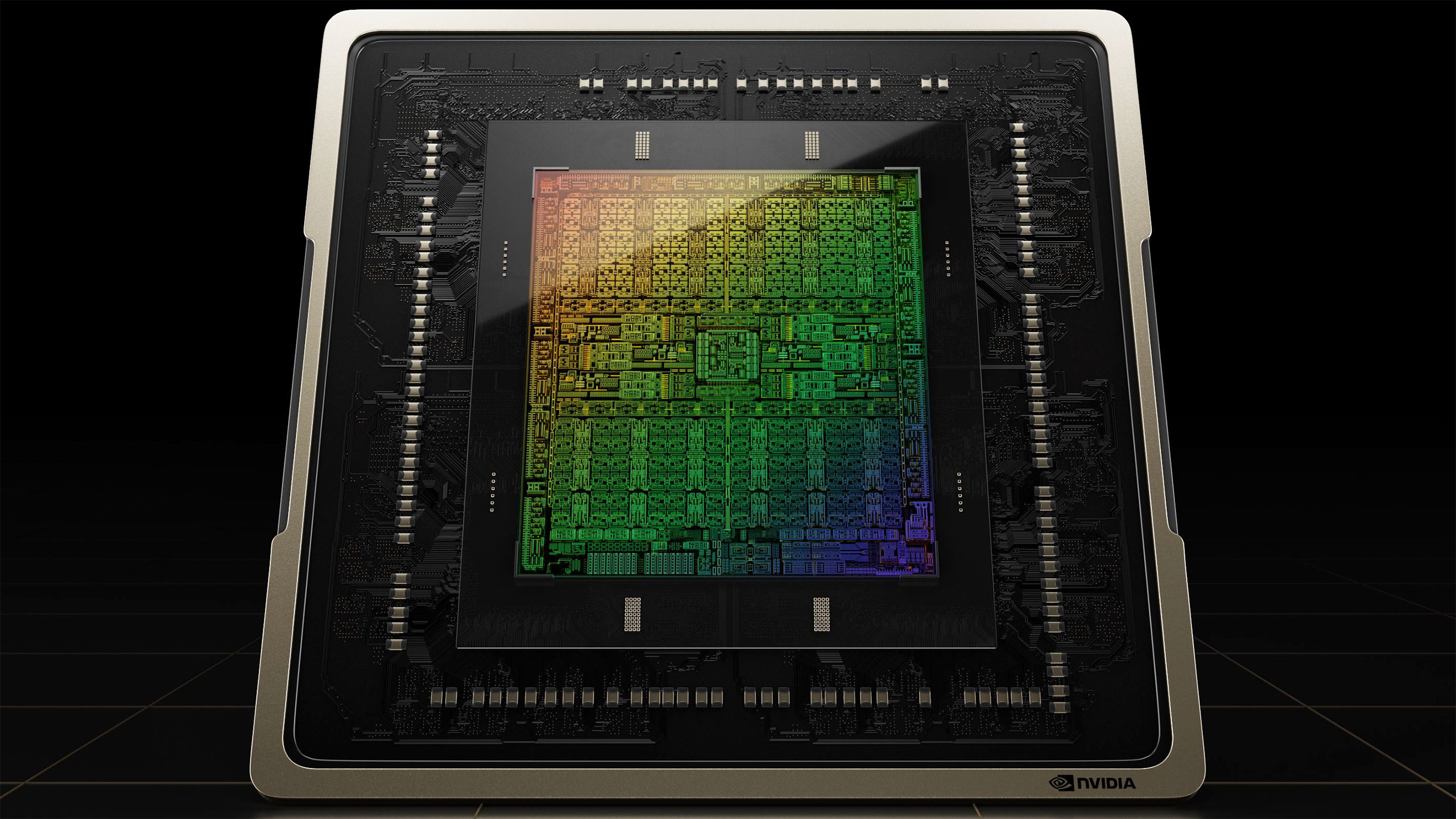

Nvidia’s CES absence is a message in itself. The company generated $51.25 billion in data center revenue in Q3 FY2026, a 66% year-over-year increase. Gaming revenue? Still profitable, but flat and far less sexy to shareholders. Jensen Huang isn’t abandoning gamers out of malice, he’s following the money, and the money is building AI empires.

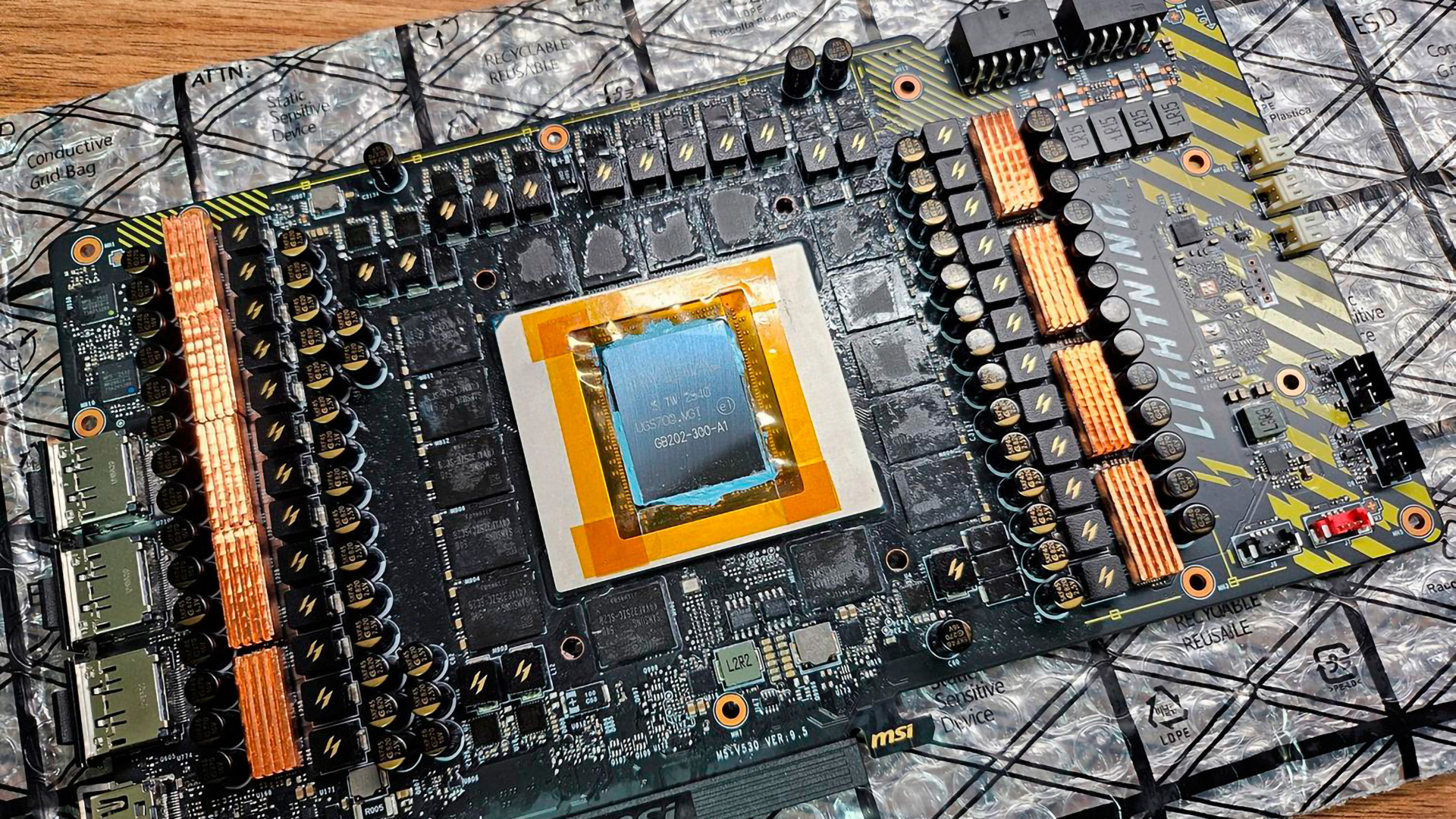

The strategy is already in motion. Rumors suggest Nvidia is considering stopping VRAM supply to board partners entirely, forcing companies like MSI and ASUS to source memory independently. This would create a Wild West pricing scenario where GPU costs vary wildly by vendor, and smaller AIB partners might simply collapse. When the memory itself becomes the bottleneck, controlling its allocation is power.

Even more telling: Nvidia is reportedly restarting RTX 3060 production in Q1 2026. The 3060 uses older GDDR6 memory on Samsung’s 8nm process, easier to source, cheaper to produce, and a lifeline for the budget segment that Nvidia’s flagship lineup has abandoned. It’s a tacit admission: the high-end consumer market is no longer sustainable under current conditions.

The Consumer GPU Is Becoming a Luxury Item

Remember when a flagship GPU was expensive but attainable? That era is over. An RTX 5090 Founders Edition already retails for $1,999, when you can find one. Third-party models are pushing $3,500 to $5,000 as scarcity drives scalper-level pricing. The German retailer whose orders were canceled predicted GPUs “will soon become very expensive”, which is corporate-speak for “you can’t afford what’s coming.”

The implications ripple outward. PC gaming, 3D rendering, and AI development on local machines are becoming hobbies for the wealthy. Students, indie developers, and budget-conscious enthusiasts are being priced out entirely. Some Reddit communities have already shifted from build recommendations to commiseration, with users joking that buying a Threadripper and 256GB of RAM last year makes them “investors, not enthusiasts.”

The strategy is already in motion. Rumors suggest Nvidia is considering stopping VRAM supply to board partners entirely, forcing companies like MSI and ASUS to source memory independently. This would create a Wild West pricing scenario where GPU costs vary wildly by vendor, and smaller AIB partners might simply collapse. When the memory itself becomes the bottleneck, controlling its allocation is power.

Even more telling: Nvidia is reportedly restarting RTX 3060 production in Q1 2026. The 3060 uses older GDDR6 memory on Samsung’s 8nm process, easier to source, cheaper to produce, and a lifeline for the budget segment that Nvidia’s flagship lineup has abandoned. It’s a tacit admission: the high-end consumer market is no longer sustainable under current conditions.

What This Means for the Future

The RTX 50-series launch debacle isn’t a temporary setback, it’s a structural realignment. Nvidia’s resource allocation, manufacturing partnerships, and public messaging all point to one conclusion: consumer GPUs are now a secondary business line, serviced only when AI demand slackens.

For gamers, this means:

– Longer upgrade cycles: Your current GPU needs to last 4-5 years, not 2-3

– Higher prices: Expect $1,000 to become the entry-level for high-end gaming

– Reduced innovation: R&D dollars flow to AI architecture, not gaming features

– Supply roulette: Even when new cards launch, availability will be sporadic

For the industry, it means:

– PC market contraction: IDC’s 9% shrinkage prediction may be optimistic

– Console shift: PlayStation and Xbox become the only “affordable” gaming options

– Cloud gaming surge: Services like GeForce NOW become necessary, not optional

– DIY market collapse: Prebuilt systems with locked-in GPU supply dominate

The most damning evidence? Nvidia is reportedly shipping GPU dies without VRAM to partners, forcing them to scrounge for memory. This isn’t a supply chain failure, it’s a supply chain abandonment. The company is effectively saying: “You figure it out. We’re busy building the AI future.”

No Savior in Sight

Some hoped AMD would capitalize on Nvidia’s consumer retreat, but Team Red faces the same memory shortages and AI demand pressures. Intel’s Arc GPUs remain a budget stopgap, not a flagship replacement. The harsh truth is that no company can escape the DRAM triopoly’s AI prioritization.

Geopolitics won’t save you either. Washington’s AI arms race with China means export controls and domestic subsidies flow to data center infrastructure, not gaming rigs. The CHIPS Act isn’t building fabs for your next GPU, it’s securing AI dominance.

So what’s a PC enthusiast to do? The pragmatic options are bleak: buy last-gen hardware, embrace cloud gaming, or pay the extortionate premiums. The romantic option, waiting for the “bubble to burst”, ignores that this isn’t a bubble. It’s a permanent reordering of semiconductor economics. AI demand isn’t speculative, it’s the new foundation.

Nvidia’s CES no-show isn’t a delay. It’s a divorce. The company that built its empire on gamers is now marrying AI, and the alimony is coming out of our wallets. The RTX 50 series may be the last consumer GPU generation that even pretended to be attainable. After this, we’re all just spectators at the AI gold rush, holding empty PCIe slots and $50 coffee gift cards.

The bottom line: Nvidia’s strategic pivot is rational business, but it marks the end of an era. The consumer GPU market isn’t dying, it’s being euthanized. And CES 2025 is where Jensen Huang is handing gamers the bill for the procedure.