NVIDIA’s $8,000 ‘Discount’ Proves Enterprise GPU Pricing is Nuts

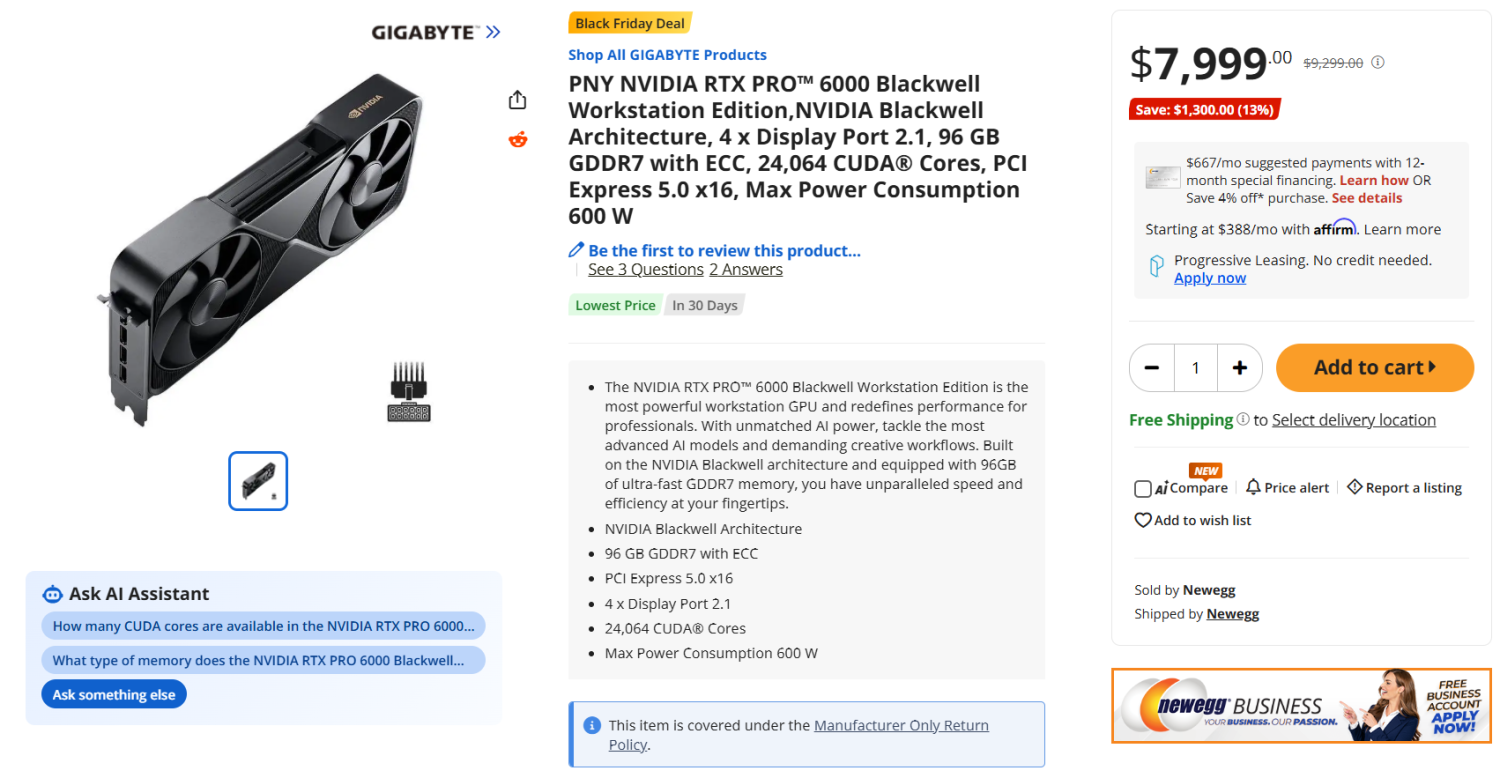

When a $1,300 price cut represents more than most people spend on their entire gaming rig, you know you’re dealing with a different class of hardware. NVIDIA’s flagship RTX PRO 6000 Blackwell workstation GPU has dropped to $7,999 at Newegg, down from its previous $9,299 price tag. On the surface, a Black Friday discount. Underneath, a subtle admission that maybe, just maybe, even enterprise customers have their limits.

The Numbers Behind the “Deal”

Let’s be clear about what we’re discussing here. This isn’t your average graphics card, it’s a professional workstation behemoth packing specifications that dwarf consumer hardware:

- 24,064 CUDA cores, nearly double the RTX 4090’s count

- 96 GB of GDDR7 ECC memory with error-correcting code functionality

- 600 W board power requiring serious workstation cooling

- PCIe 5.0 x16 interface and four DisplayPort 2.1 outputs

When the RTX PRO 6000 first appeared at US enterprise retailers earlier this year, it showed up at $8,565, about 26% higher than the previous-generation RTX 6000 Ada. That’s when the Ada card itself launched at $6,800 MSRP, establishing a pattern of generational price increases that would make Apple blush.

NVIDIA eventually saw this card reach $11,000 on other platforms, but generally speaking, the flagship GB202 GPU for desktops was available for at least $9,000 most of the time. Which makes the current $7,999 price point feel less like a discount and more like a market correction.

The Ghost of Quadro Past

The timing and magnitude of this price drop inevitably brings to mind NVIDIA’s historical pricing experiments. Remember the RTX Quadro 8000? That card launched at a similarly eye-watering price point before eventually finding its market level. The parallel isn’t lost on industry observers, when flagship professional cards start seeing significant discounts this quickly after launch, it suggests NVIDIA might have overestimated demand or pricing tolerance.

On developer forums, many are questioning whether enterprise GPU pricing has reached an inflection point. The prevailing sentiment suggests that while AI workloads continue to demand more performance, the value proposition for single-GPU workstations at this price range is becoming increasingly difficult to justify against cloud alternatives.

Who Actually Buys These Cards?

This isn’t hardware for your average developer workstation. At these price points, we’re squarely in enterprise territory where the calculus changes dramatically. The RTX PRO 6000’s target market includes:

- AI research organizations training models that can’t fit in consumer GPU memory

- Visual effects studios working with massive 8K+ footage and complex simulations

- Engineering firms running computational fluid dynamics and finite element analysis

- Scientific institutions processing enormous datasets in fields like genomics and particle physics

What’s telling about this price cut is that it’s happening at Newegg, historically a consumer-focused retailer. This suggests NVIDIA and its board partners are testing price sensitivity even in channels not traditionally associated with enterprise sales.

The Cloud vs. On-Prem Calculus

Here’s where the pricing gets really interesting. At nearly $8,000 per card (plus the substantial workstation required to host it), organizations have to ask whether on-premises hardware still makes sense versus cloud alternatives. Consider:

- Multiple RTX PRO 6000 cards could be installed into a single system for massive performance increases, with 384GB of GDDR7 memory through four cards installed, requiring 2400W power consumption total

- Equivalent cloud instances offer flexibility without massive capital expenditure

- The total cost of ownership calculations become increasingly complex when factoring in power, cooling, and refresh cycles

- For many organizations, the cloud’s pay-as-you-go model provides better financial optics than eight thousand dollar hardware purchases

Still, for organizations with consistent, heavy workloads or data sovereignty requirements, the appeal of dedicated hardware remains strong. The question becomes whether NVIDIA’s pricing strategy aligns with that value proposition.

The Memory Premium

One critical factor driving these prices: memory. In a current market where RAM prices are absolutely skyrocketing out of control, the 96GB card’s pricing includes a substantial memory premium. NVIDIA has placed the GDDR7 memory on both sides of the PCB, with each side featuring 48GB GDDR7 for a full 96GB using 3GB GDDR7 memory modules.

This double-sided memory configuration isn’t just expensive, it’s complex to manufacture and requires sophisticated cooling solutions. When you’re paying for 96GB of high-speed ECC memory, you’re not just buying computation, you’re buying the ability to handle datasets that would choke consumer hardware.

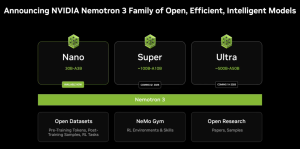

The Blackwell Context

The RTX PRO 6000 represents the best of Blackwell before you shift over to HBM-based GPUs like the H200, B200, and upcoming R100 AI GPUs using HBM3, HBM3E, and HBM4, respectively. It’s essentially the bridge between traditional workstation graphics and the hyperscale AI accelerators that dominate NVIDIA’s data center revenue.

This positioning makes the pricing particularly strategic. At $7,999, it’s expensive enough to maintain margin while being (theoretically) accessible enough for organizations that can’t justify six-figure server deployments.

What This Means for Enterprise AI

- Price sensitivity is real, even at the high end of the market

- Cloud competition is intensifying, making on-prem hardware harder to justify

- Generational pricing increases may have hit their limit, enterprise buyers are pushing back

- The professional workstation market is becoming more stratified, with clear separation between prosumer and true enterprise tiers

This isn’t just about one GPU getting a Black Friday discount. It’s about whether the entire enterprise GPU pricing structure is sustainable in an era where cloud computing offers increasingly compelling alternatives for AI workloads.

The Bottom Line: Value at What Cost?

The new $7,999 tag still keeps the RTX PRO 6000 in a different league from gaming cards. In fact, it’s so expensive that this price cut alone represents the value of a high-end RTX 5080 GPU.

For organizations that genuinely need this level of performance and memory, the price might still make sense. But for everyone else? The message seems clear: the era of treating high-end workstation GPUs as general-purpose AI accelerators might be ending. As cloud options mature and pricing pressure increases, even NVIDIA’s most powerful workstation cards aren’t immune to market forces.

The real question isn’t whether $7,999 is a good deal, it’s whether any single-GPU workstation at this price point can survive the coming wave of distributed computing and specialized AI hardware. If NVIDIA’s flagship professional card needs price adjustments this quickly after launch, the entire enterprise GPU market might be at a crossroads.