The $8 Trillion AI Infrastructure Mirage: When Capex Math Doesn’t Add Up

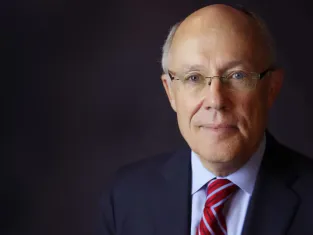

The AI infrastructure gold rush is hitting a sobering reality check. While tech giants race to build the computational foundation for artificial intelligence, one industry veteran is questioning whether the most ambitious construction project in tech history makes financial sense. IBM CEO Arvind Krishna recently dropped a bombshell during a “Decoder” podcast interview that should give every technology executive pause: the math on AI data center returns simply doesn’t work.

The Trillion-Dollar Reality Check

Krishna’s argument centers on brutally simple arithmetic. “It takes about $80 billion to fill up a one-gigawatt data center,” he stated. “If you are going to commit 20 to 30 gigawatts, that’s one company, that’s $1.5 trillion of capex.” Scaling this to global commitments chasing artificial general intelligence (AGI), Krishna estimates we’re looking at roughly $8 trillion in total capital expenditures.

The numbers get even more sobering when you consider financing costs. “$8 trillion of CapEx means you need roughly $800 billion of profit just to pay for the interest,” Krishna calculated. To put that in perspective, Microsoft’s entire annual revenue hovers around $200 billion, meaning you’d need four Microsofts worth of pure profit just to service the debt on this AI infrastructure buildout.

But perhaps the most overlooked factor is depreciation. “You’ve got to use it all in five years because at that point, you’ve got to throw it away and refill it,” Krishna noted, referencing the rapid obsolescence cycle of AI chips. This isn’t theoretical, investor Michael Burry has recently taken aim at Nvidia over similar depreciation concerns.

The AI Capex Arms Race Hits Hyperscale

The scale of current commitments borders on surreal. According to Bank of America analysis, Oracle alone expects to commit $300 billion toward AI-focused data center expansion. U.S. spending on data center construction surged 92.8% through September 2025, reaching $32.9 billion according to Westside Construction Group, with billion-dollar facilities becoming increasingly common.

This isn’t just about real estate, it’s about energy infrastructure too. In an October letter to the White House’s Office of Science and Technology Policy, OpenAI CEO Sam Altman recommended that the US add 100 gigawatts in energy capacity every year, equivalent to adding the entire current capacity of Texas’ power grid annually.

When Faith Trumps Finance

The fundamental disconnect Krishna identifies is between financial reality and technological faith. When challenged about Altman’s belief that OpenAI could generate returns on its $1.4 trillion spending commitment, Krishna’s response was telling: “That’s a belief. That’s what some people like to chase. I understand that from their perspective, but that’s different from agreeing with them.”

This faith-based investment thesis has spread throughout the industry. Nvidia recently predicted that data center capital spending would grow at an annualized rate of 40% through 2030, landing between $3 trillion and $4 trillion by the end of that period according to The Motley Fool. That represents a 400% increase from today’s estimated $700 billion in data center capex.

The AGI Mirage: Chasing Technological Ghosts

Much of this spending is justified by the pursuit of Artificial General Intelligence, the holy grail of AI that could reason across domains like humans. But here too, Krishna injects skepticism. He pegs the chances of achieving AGI with current technology at 0-1%, stating it will require “more technologies than the current LLM path.”

He’s not alone in this skepticism. Google Brain founder Andrew Ng calls AGI overhyped, while Mistral CEO Arthur Mensch describes it as a marketing move. Even OpenAI cofounder Ilya Sutskever recently declared that the age of scaling was over, noting that “even 100x scaling of LLMs would not be completely transformative.”

The Revenue-Reality Gap

So where’s the actual return coming from? The disconnect between infrastructure costs and revenue potential is staggering. While companies are spending billions, enterprise adoption of generative AI remains problematic. A MIT report found that 95% of organizations get zero return on GenAI pilots.

The inference cost problem compounds this issue. Running AI models at scale costs significantly more than training them, and enterprises haven’t proven willing to pay premium prices for AI services that don’t deliver clear ROI. As Benzinga notes, “If capex continues to balloon while monetization remains vague, someone is going to hit the brakes.”

The Winners in This Arms Race

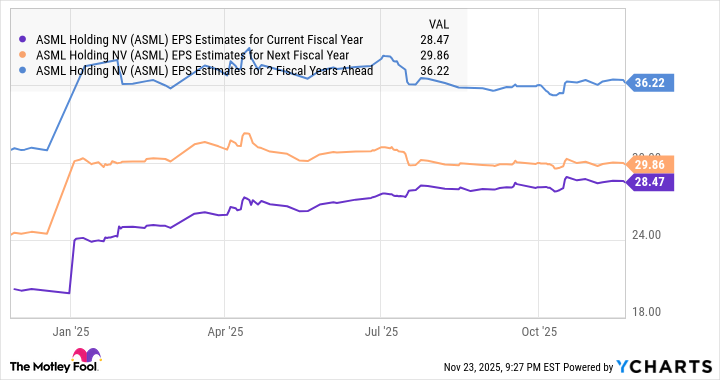

While the hyperscalers might be building infrastructure they can’t profit from, the companies supplying the picks and shovels are thriving. Nvidia generated $51.2 billion in data center revenue in a single quarter, while semiconductor equipment manufacturer ASML reported €7.5 billion in quarterly sales from advanced chipmaking machines.

These suppliers benefit from the infrastructure buildout without the stranded asset risk. As companies race to build more advanced chips, ASML’s extreme ultraviolet (EUV) lithography machines, which cost hundreds of millions each, have become essential equipment in the AI arms race.

The Coming Financial Reckoning

The question isn’t whether AI has value, Krishna acknowledges it “will unlock trillions of dollars of productivity in the enterprise”, but whether the current infrastructure spending spree makes financial sense. The numbers suggest we’re heading for a collision between technological ambition and balance sheet reality.

As Krishna bluntly concluded: “It’s my view that there’s no way you’re going to get a return on that.” The first company to pause spending could trigger a wider market reassessment of AI infrastructure profitability, exposing how much of this build-out relies on narrative economics rather than sustainable business models.

The AI revolution is real, but the capital-intensive infrastructure model might not be. Technology leaders face a critical question: are they building the future or constructing the largest financial mirage in tech history? The answer may determine which companies survive when the market finally demands ROI proof, not just AI promises.